The government’s trumpeted investment in infrastructure is little different to previous Prime Ministers, per annum, it is “only offering $7.5 billion a year, much of it already in Hockey’s numbers and a fair swag of that dating from Labor government commitments. …If the Abbott government had kept … promise, it would have averaged $8.3 billion a year.” (Michael Pascoe, SMH 10/5/17) and Rudd/Gillard infrastructure investment was higher.

Set against the Federal budget, the NSW government sold/leased ~$34 billion of electricity infrastructure and services which, using Professor John Quiggan’s general privatisation cost estimate, will cost the public a 10% return to the purchasers ie $3.4 billion a year while reducing services by more than that amount.

Hence just one state disposing of one asset area has committed Australia to annually spend nearly half of the Federal budget’s annual infrastructure investment, as a return to purchasers.

The national outflow and redirection of funds away from delivering critical services in privatised/leased State government infrastructure and services massively dwarfs any planned Federal infrastructure investment in Budget 2017 making it almost irrelevant.

Pascoe also mentions that Infrastructure Australia ranks the cost benefit ratio of one $10 billion rail project “marginal” and IA have “a list of projects that score much more highly”. The budget items are a clear benefit to politicians re election ambitions but include some questionable returns to the taxpayer and overall questionable, if any, stimulus to the economy.

On the other hand, investment in human infrastructure, or human capital as economists say, is whittled down at any opportunity. Seemingly considered “bad” using the government’s newly minted good and bad investment criteria.

Tertiary education funding cuts for example will impact a system already poorly funded: “Australia is pulled down (by) the low ranking of 44 out of 50 for government expenditure on higher education…student contributions to higher education were the sixth highest in the world…” (Universitas 21 analysis, Julie Hare, The Australian 5/5/17)

Still no recognition that efficient primary health care reduces later higher costs and unnecessary disabilities with a fudged response to freezes of Medicare rebates impacting GPs, Optometrists etc. “GP…rebates have fallen 120% behind practice costs over the last 25 years” (Paul Mara, theguardian 23/5/17)

The same lack of recognition exists for investing in public education to deliver positive long term impacts on low income and disadvantaged children and citizens which will uplift Australia’s future performance.

In an environment where:

- disposable income per capita has been falling since 2011

- household debt is the fourth highest in the OECD

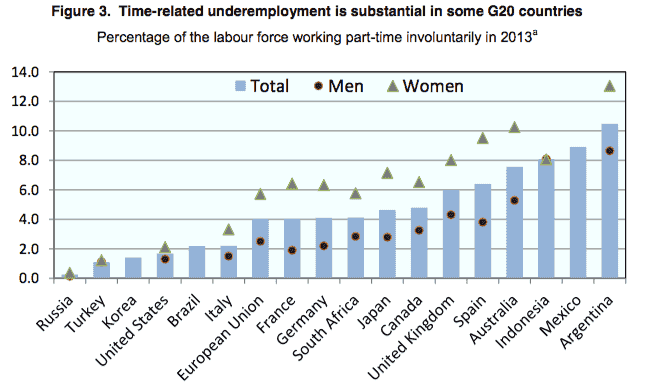

- underemployment plus unemployment wavers up to 20%

- education outcomes are deteriorating, 24th out of 37 OECD countries – UNICEF

- health care is deteriorating, 27th out of 35 OECD countries – UNICEF

the budget does not respond to these challenges.

The budget fails to reap the many opportunities for substantial long term gains and reduced social costs available from investing in human capital.

Ref